eBusiness Weekly

Golden Sibanda

Zimbabwe is one of only two Southern African countries that failed to reduce inflation in 2019, along with Angola, but the country is projected to record phenomenal decline next year with the rate forecast to plunge to 4,5 percent from current lofty levels of over 700 percent.

In 2019, Zimbabwe remained the outlier in the region with its inflation hitting three-digit figures of over 200 percent as a result of exchange rate distortions, money supply growth, liquidity shortages, a persistent rise in prices of fuel, power and food, as well as adverse inflation expectations.

Zimbabwe enjoyed significantly low and stable inflation post dollarisation in 2009, after it dumped its domestic currency following high levels of inflation, which peaked to 231 million percent at the last official count in July 2009.

Unrestrained inflation increase, since October 2018 and at least until May this year, which has come against the backdrop of a weakening domestic currency, has seen the majority of economic agents preferring to transact in US dollars.

“Inflation is projected to remain at the same levels in 2020, before falling to 4,5 percent in 2021,” the African Development Bank (AfDB) noted in its recent Southern African Economic Outlook (Coping with Covid-19 pandemic).

The AfDB said tight monetary policy in many countries in the region made it possible to reduce inflation (annualised), with single-digit figures projected in countries such as Botswana, Eswatini, Mozambique and Namibia for 2019 and 2020.

The regional bank also noted that depreciation had significant knock-on effect on inflation, debt management and servicing. In Zimbabwe’s case the inflation threshold fell outside the region’s macroeconomic convergence range of 3-7 percent used to measure stability.

“Except for Angola and Zimbabwe, all the countries are forecast to continue enjoying single-digit inflation in 2020 and 2021,” AfDB said.

Zimbabwe’s inflation increase, is by far the most remarkable largely driven by continuously weakening currency. According to AfDB latest research findings the Zimbabwe dollar depreciated by the widest margin of all regional currencies between 2017 and 2019 after its value dropped 700 percent against the US dollar.

This has seen Zimbabwe’s inflation register an exponential increase from lowly 5,39 percent in September 2018 to 785,6 percent by May before easing to 737 percent in June, and it is expected the rate will be keeping declining as the exchange rate stabilises.

Zimbabwe in June adopted the auction system exchange rate regime, after scrapping the fixed rate introduced in March, which had in turn replaced the interbank market that was in place since February 2019 after the country reintroduced its domestic currency since 2009.

Other significant down slides were registered in the Angola Kwanza, which shed 95 percent of its US dollar exchange value and the Zambian Kwacha, which came off 30 percent against the greenback.

All the regional countries experienced depreciation of their currencies against the US dollar except for Mozambique and São Tomé & Príncipe, AfDB did not state its reasons for projected massive inflation drop in Zimbabwe.

“Three countries that had significant depreciation of their currencies between 2017 and 2019 were Angola (95 percent), Zambia (30,5 percent) and Madagascar (14 percent). Zimbabwe was the outlier with a depreciation of 700,7 percent,” according to the AfDB.

Moderate depreciation of the local currencies took place in Mauritius (1,2 percent), Malawi (2,7 percent), and Botswana (3,2 percent).

However, Covid-19 pandemic has started to put pressure on the exchange rates in the region. The pandemic has already infected more than 2,5 million people worldwide, while over half a million have succumbed to the virus with little respite in sight.

It is projected that the global recession due to the global pandemic, coupled with the decline in export revenues of many southern African economies, capital flight and high demand for US dollars amidst growing global uncertainties, may lead to further depreciation of the region’s currencies.

Weak economic performance is expected across the globe due to the pandemic, amid widespread national lockdowns, disrupted global supply chains, lower demand, loss of hundreds of thousands lives, jobs and shuttered economies.

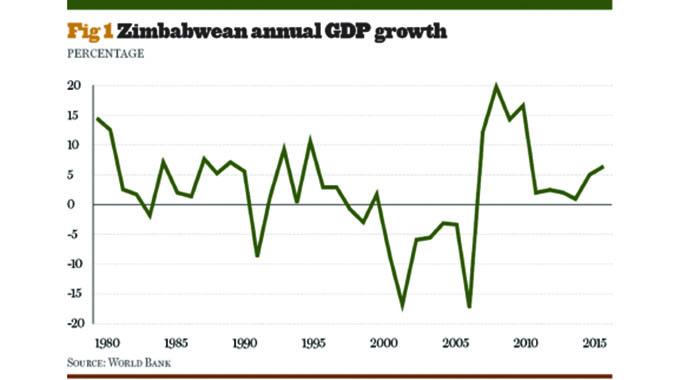

Finance Minister Mthuli Ncube has projected, in his 2020 Mid-Term Budget Review, that Zimbabwe’s economy will contract by 4,5 percent this year instead of the earlier projected expansion of 3 percent.

AfDB says Zimbabwe’s economy contracted 8,5 percent last year, due to the negative impact Cyclone Idai and drought. But Minister Ncube said the economy would contract by 6,5 percent in 2019.